No products in the cart.

Bookkeeping

Manufacturing and Non-manufacturing Costs: Online Accounting Tutorial & Questions

For that purpose, the company used sensors to collect and analyze the cost of materials in real time to see how to optimize the costs. Knowing the overhead cost per unit is helpful in understanding what the manufacturing overhead costs will be if the company plans to double their production (in other words, make 40,000 smartphones) in the future, for instance. Be sure to allocate overhead costs to the respective cost centers (specific departments, processes, or machines in the manufacturing facility that contribute to the manufacturing costs).

Managerial Accounting

- By calculating manufacturing costs, companies can clearly understand the true cost of making a product.

- These costs do not specifically contribute to the actual production of goods but are essential to ensure overall functioning of the business.

- Nonmanufacturing overhead costs are the business expenses that are outside of a company’s manufacturing operations.

- For this reason, firms expense (deduct from revenues) period costs in the period in which they are incurred.

- That part of a manufacturer’s inventory that is in the production process and has not yet been completed and transferred to the finished goods inventory.

- For a manufacturer these are expenses outside of the manufacturing function.

Many employees receive fringe benefits—employers pay for payroll taxes, pension costs, and paid vacations. These fringe benefit costs can significantly increase the direct labor hourly wage rate. Other companies include fringe benefit costs in overhead if they can be traced to the product only with great difficulty and effort. Manufacturing cost is the core cost categorization for a manufacturing entity. It encompasses the costs that must be incurred so as to produce marketable inventory.

Top 5 Career Options for Accounting Graduates

With a breakup of all the costs of manufacturing, management can decide whether it is more profitable to purchase certain parts or materials from a vendor or manufacture them in-house. As you can see, by collecting cost data and calculating it accurately, businesses can optimize cost management and set the right price for their products to gain a competitive advantage. Here’s an interesting case study on how manufacturing cost analysis helped a steel manufacturing company save costs.

Direct Labor

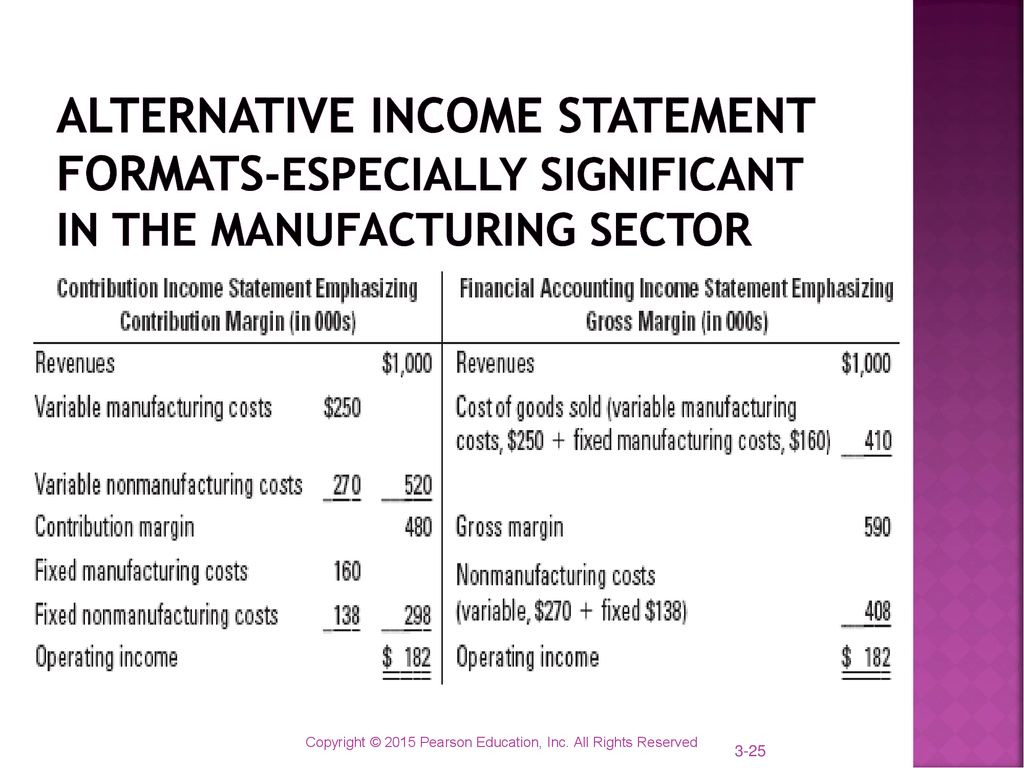

In addition to indirect materials and indirect labor, manufacturing overhead includes depreciation and maintenance on machines and factory utility costs. Look at the following for more examples of manufacturing overhead costs. Distinguishing between the two categories is critical because the category determines where a cost will appear in the financial statements.

Manufacturing costs are also known as factory costs or production costs. For instance, let’s say the hourly rate a manufacturing company pays to its employees is $30. Tracking the number of hours each employee works on the production line can be tricky. This is where a manufacturing time tracking app, such as Clockify, comes in handy. Direct materials are raw materials that become an integral part of the finished goods. When inventory items are acquired or produced at varying costs, the company will need to make an assumption on how to flow the changing costs.

These costs have two components—selling costs and general and administrative costs—which are described next. Firms account for some labor costs (for example, wages of materials handlers, custodial workers, and supervisors) as indirect labor because the expense of tracing these costs to products would be too great. Indirect labor consists of the cost of labor that cannot, or will not for practical reasons, be traced to the products being manufactured. As their names indicate, direct material and direct labor costs are directly traceable to the products being manufactured. Manufacturing overhead, however, consists of indirect factory-related costs and as such must be divided up and allocated to each unit produced. For example, the property tax on a factory building is part of manufacturing overhead.

As with direct material costs, direct labor costs of a product include only those labor costs clearly traceable to, or readily identifiable with, the finished product. The wages paid to a construction worker, a pizza delivery driver, and an assembler in an electronics company are examples of direct labor. Note that all of the items in the list above pertain to the manufacturing function of the business. Rather, nonmanufacturing expenses are reported separately (as SG&A and interest expense) on the income statement for the accounting period in which they are incurred. The wood used to build tables and the hardware used to attach table legs would be considered direct materials.

Direct labor would include the workers who use the wood, hardware, glue, lacquer, and other materials to build tables. In fact, you already know that labor costs can expensing vs capitalizing in finance business literacy institute financial intelligence spiral out of control if you don’t meticulously monitor them. Manufacturers can compare the costs of making a product using different manufacturing processes.